20 Oct What type of House Can also be a seasoned Rating that have Va Home Mortgage?

Experts has served our very own country and set their lives on the line to safeguard the independence. He has got produced of several sacrifices, together with making their loved ones trailing, so you can serve. Once the experts will often have difficulty wanting employment when they return to civil lifestyle along with their army degree not being transferable so you're able to new civil business, it could be tough to assistance on their own and their family. The newest Va financing lets veterans to acquire property with no advance payment and you may low interest rates, which can only help them immensely. Exactly what kind of household is also experts get with good Virtual assistant family?

While you are an experienced thinking of buying property, make sure to ask your bank on how to make an application for good Virtual assistant loan and read to discover more about the fresh particular family you can purchase!

The benefits of a great Virtual assistant Mortgage getting Veterans

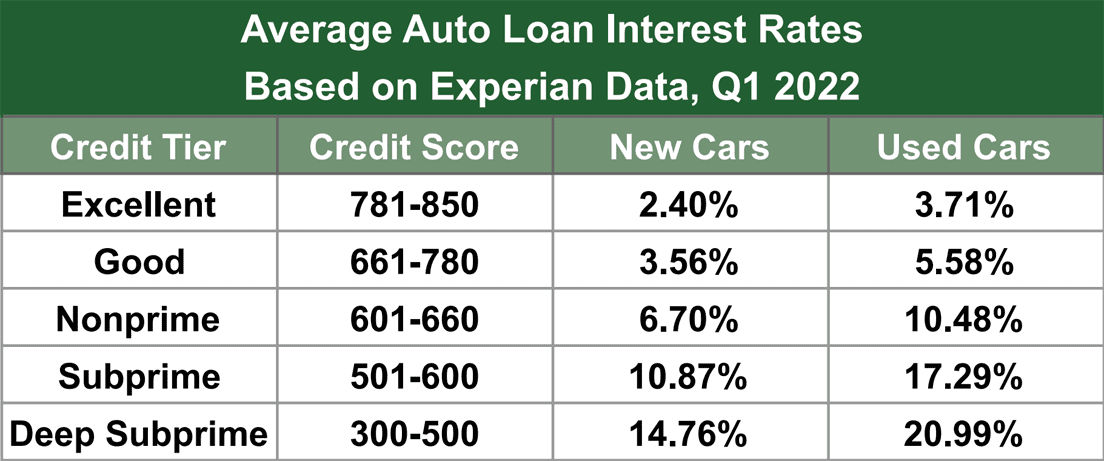

If you find yourself a seasoned, leveraging an excellent Virtual assistant mortgage when buying a house simply is practical. For starters, Va finance promote competitive rates of interest and you can terms, that will save yourself pros money across the life of the loan. Concurrently, Virtual assistant fund not one of them a down payment, which could make homeownership cheaper having pros.

An additional benefit regarding Va money is they is actually supported by the federal government, causing them to more secure than many other style of money. Consequently in the event the a seasoned defaults on their loan, the lender are not kept carrying the newest bag.

Va Loan Qualifications

If you are a seasoned browsing purchase a home, you might be questioning when you're entitled to the fresh Va family loan system. Virtual assistant fund are around for licensed pros, reservists, and effective-obligation solution participants, and offer several advantages you to definitely almost every other money never.