Household Equity Financing or Line of credit to have Debt consolidating

Each other home guarantee fund and household security lines of credit is be employed to combine existing loans, commonly saving you currency. It is which the best choice for your?

Of several or every companies looked promote settlement to help you LendEDU. This type of commissions was how we take care of the totally free solution to have consumerspensation, plus period of inside-breadth article research, decides in which & just how people show up on our web site.

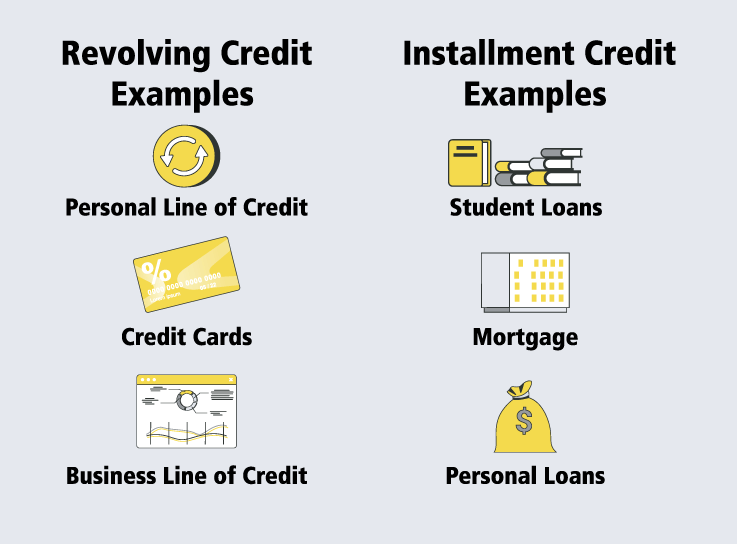

Of many house carry extreme degrees of loans ranging from the mortgages, unsecured loans, mastercard stability, figuratively speaking, plus. In fact, the typical Western enjoys $90,460 worth of debt, best of many to help you ponder if they can tap into the property with property guarantee mortgage to own debt consolidating.

If you've accumulated guarantee of your home, you could believe opening these types of finance to help you consolidate your own loans and begin paying it off faster. This may not merely make clear your instalments and lock in a possibly lower rate of interest than simply you happen to be using elsewhere, helping you save money over the years.

But simply while the home security finance or credit lines was out there doesn't invariably indicate he could be usually the best options.